A China Eastern Airlines Airbus A320-200 (foreground) and Boeing 737-800.

Manufacturing mainline aircraft is a natural monopoly that governments and airlines prevent from becoming an actual monopoly by sustaining at least two major OEMs. This approach preserves competition as well as most of the scale economics that a monopoly would bring. The result has been a roughly even Airbus-Boeing contest, now complemented at the low end by Embraer E2s, and has generally served airlines well.

But markets shift. The 737 MAX agony left Boeing well behind Airbus in narrowbody prospects, and a cutback in orders from China’s huge market has further worsened the prospect of US OEM sales. In scale industries, size matters because fixed costs can be spread across more units, giving leaders a further advantage.

But observers are also questioning how long China will continue its rapid economic and aviation growth with a declining and aging population. Combine this question with Boeing’s slippage, and the aircraft purchasing landscape airlines will face in the future is looking increasingly blurry.

Boeing’s problems in China started with the MAX in 2018, well before COVID, with the first of two fatal crashes. In 2019, after the second crash, the aircraft was grounded, dramatically slowing new orders. The pandemic and subsequent design and delivery problems at Boeing further affected orders, although demand for the MAX has returned.

Chinese carriers had taken 125 Boeing aircraft in 2018, but took only 35 in 2019, three in COVID-hit 2020, four in 2021 and 11 in 2022. Airbus’ Chinese business was also hit by the pandemic but has recovered much more strongly than Boeing’s.

In an Aviation Week Check 6 podcast, Sash Tusa, an analyst at the UK’s Agency Partners, attributed much of Airbus’ strength in China to the opening of its final assembly line (FAL) in Tianjin country in 2009. The European airframe OEM had only 10%-15% of the market in 2009.

“Boeing owned the market,” Tusa noted. Airbus’ share has risen steadily since.

Aerodynamic Advisory’s Richard Aboulafia traces Boeing’s slippage to different causes: The US-China trade conflict begun under President Trump has continued and intensified under the Biden Administration. “Boeing is a hostage to that,” Aboulafia argues. And tensions over Taiwan could lead to much more disrupted trade or worse.

In any case, there are limited prospects for a turnaround. “Assuming that the current geopolitical environment doesn’t radically improve soon, then I doubt you’ll see many Chinese orders for Boeing,” Teal Group senior analyst Bruce McClelland said. “It may be that China quietly lets undisclosed orders get delivered, but don’t expect any big public announcements.”

McClelland too sees China using Boeing as way to show its displeasure at US policies. “Favoring Airbus helps China pursue its aim of getting Europe to hew to a more Chinese-friendly path,” he said.

Opportunties

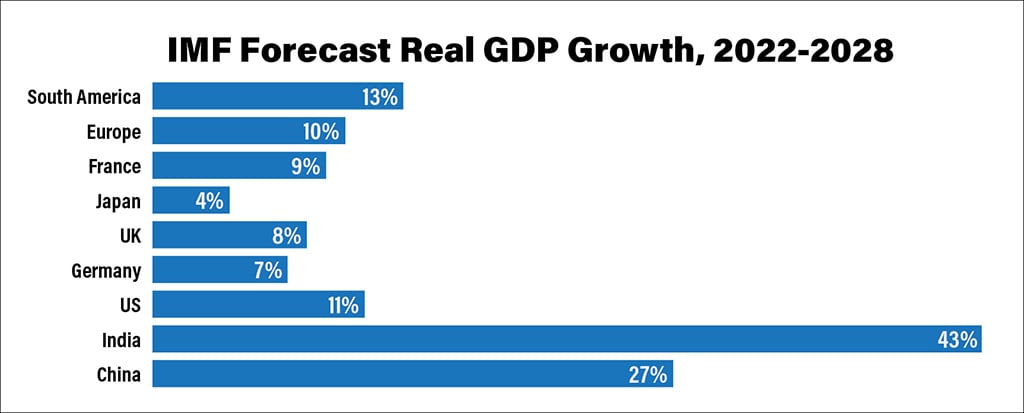

How much does this matter to Boeing? It’s significant, but maybe not as drastic as it appears, especially in light of other fast-growing markets. For example, India’s economy was only one-sixth the size of China’s in 2021 but averaged 7% annual growth before COVID. The International Monetary Fund (IMF) projects that India will account for 13% of global economic growth in the next five years, more than half the 23% share expected from China. US civil aviation exports to the Middle East were growing 7% annually before COVID, a pace that should roughly resume as the virus passes. South American economies are also expected to grow significantly.

These other opportunities have a hopeful implication.

“China’s not a big problem for Boeing,” Aboulafia insists. He judges that Airbus’ backlog now has about two-thirds of the high-volume, low-margin narrowbody global market, while Boeing has two-thirds of the low-volume, high-margin widebody market.

Even Boeing’s reduced share of narrowbodies should translate eventually into 40-50 737s produced per month, which the Aerodynamic analyst says does not drive unit costs up too much. “They produced 30 per month with respectable margins,” Aboulafia said, adding that he thinks Boeing will still recover at least some share of the China market as growth resumes.

McClelland essentially agrees, seeing China as a “long but still moderate challenge for Boeing.”

Teal Group estimates that China, including Hong Kong and some undisclosed orders, represents only 13%-14% of the global backlog of aircraft orders. And it estimates that Airbus and Boeing have similar portions of their own backlogs dedicated to China, although, “Boeing’s China backlog is probably shakier than Airbus’.”

Overall, “Boeing is just going to have to work harder than Airbus to make itself successful in the rest of the world, McClelland said.

Not that China will cease playing a major role in aviation as in the rest of the global economy. GDP drives aviation, especially in less-mature markets. China’s official real GDP, sometimes questioned, grew an average of 8% annually in the decade before COVID, slowing only to 7% annual growth in the last five years before the virus hit. The latest estimates are that the nation will achieve 6% real growth in 2023.

This growth has been achieved despite slowing population growth and, from around 2014, a flat labor force. Real GDP per worker was rising 8% annually in the decade before the virus. Chinese brains, hard work and high savings, not more Chinese, have chiefly been responsible for the country’s growth.

Now the country is headed for a long decline in population. The United Nation’s mid-case estimate puts China’s 2050 population at 1.317 billion, while another private forecaster puts it even lower, at 1.312 billion. Both figures are well down from 2022’s 1.426 billion. These estimates imply a decline of about 0.3% annually in the population.

By itself, that would not slow growth down much, but other factors will. First, when a country loses population because of declining fertility rates, it also means the population is aging, and that means fewer workers. This has already happened to some degree. China’s labor force participation rate was near 60% early in the 21st century but decreased to 55% on the eve of COVID.

By 2050, only 55% of China’s population is expected to even be in the prime working age group of 20 to 64, according to forecasters at PopulationPyramid.net. By way of contrast, India’s expected population of 1.67 billion is predicted to still be growing and to have 61% of its people in the prime working ages by 2050.

Second, of course, the richer a country gets, the harder it is to maintain rapid growth. After China shed Marxist economics, annual growth rates were often in double digits in the early 1980s and 1990s. More recently, they have been about half that rate. A gradual slowing of the growth per highly industrious Chinese worker is therefore likely.

It is therefore not surprising that forecasters differ widely on China’s future economic growth. Many still see 3.5%-5% average annual growth continuing until mid-century. But skeptics like researchers at the Lowy Institute see an average of 2%-3%. Small differences in compounding growth rates imply big differences in the ultimate size of the market.

Bounce-Back

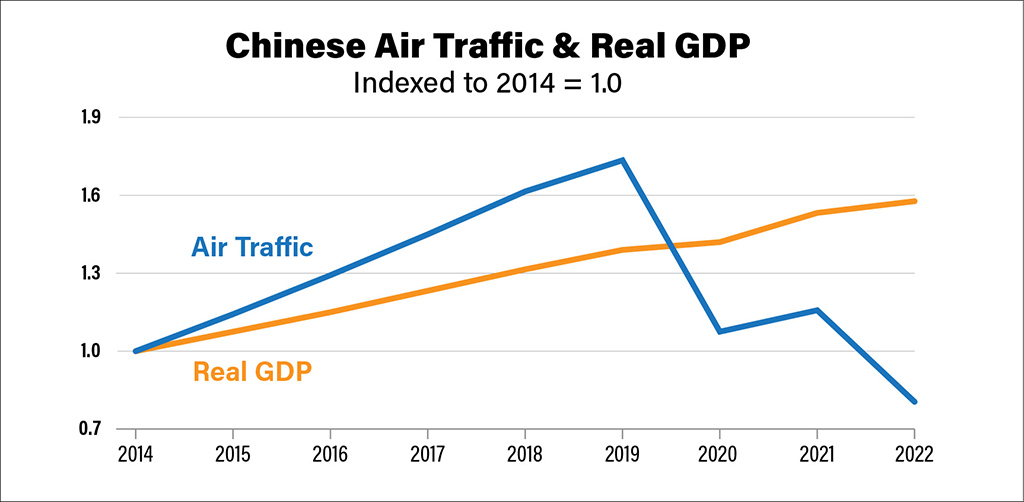

But short-term, there is no doubt of a strong bounce-back in Chinese aviation. China’s air traffic was growing even more rapidly than its economy pre-COVID and took a much sharper dive during the pandemic.

Air travel should therefore recover very strongly as restrictions are lifted in China and across Asia-Pacific nations, as has been the case this year. China’s February 2023 total traffic, passenger plus cargo, was up 29% over same month of 2022.

That favors the environment for at least some progress in China by Boeing.

“If Chinese traffic starts to surge ... then you could see a softening of China’s stance toward Boeing,” McClelland argues. One early sign may be Hong Kong’s Greater Bay Airlines’ recent order for 15 MAXs and five 787s. And in late April, Chinese regulators published a report viewed as easing deliveries of new MAXs to China. Boeing has stored more than 130 MAXs destined for China. Finally, McClelland believes that Airbus and Boeing each have a significant number of undisclosed Chinese orders.

Even under trade and political tensions, the US is not without leverage on China’s aircraft purchasing policies. Wolfe Research analyst Myles Walton points out that half the systems on China’s COMAC C919, intended to compete in the narrowbody market, come from US suppliers.

“Abandonment by China of Boeing planes would be an untenable outcome for US policymakers to allow technology sharing to continue,” he said.

So a disadvantage in, but not an exclusion from, the Chinese market looks most likely for Boeing. And this market will still be huge, albeit probably declining in relative importance in the future.

And, like China, the US OEM is recovering, with first-quarter revenue up 28%, year-over-year, expecting to produce 38 737s later this year and a backlog of more than 4,500 commercial aircraft.

In Boeing’s first-quarter earnings call, CEO Dave Calhoun noted that China’s domestic travel was at pre-pandemic levels and would continue to grow.

“So, they need airplanes,” he noted.

The company also said all MAX operators in China had returned to flying their aircraft and 45 of the 95 737 MAXs in China were back in service.