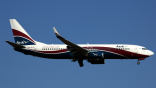

NG Eagle's inaugural flight took off on Dec. 10.

Nigerian startup NG Eagle has operated its first commercial flight, entering the market on the West African country’s busiest domestic route. The airline’s inaugural flight took off on Dec. 10, connecting Nigeria’s capital Abuja with the nation’s most populous city Lagos. The service was operated...

Subscription Required

This content requires a subscription to one of the Aviation Week Intelligence Network (AWIN) bundles.

Schedule a demo today to find out how you can access this content and similar content related to your area of the global aviation industry.

Already an AWIN subscriber? Login

Did you know? Aviation Week has won top honors multiple times in the Jesse H. Neal National Business Journalism Awards, the business-to-business media equivalent of the Pulitzer Prizes.