The president of Russia’s United Aircraft Corp. says Russia and China are going to revise their joint widebody project, the Craic CR929, due to the added pressure of Western sanctions imposed on Russia as a consequence of the country’s invasion of Ukraine.

- Russia proposes dropping Western suppliers

- Comac to stay with international approach

- Aircraft design changes loom

Progress on the program has been slow because of complicated negotiations over workshare and the politics of a major program. Now the partners are offering differing views about how to move forward, putting the program’s timeline in further jeopardy.

Yury Slyusar, president of Russia’s United Aircraft Corp. (UAC), confirms that big changes are needed. Slyusar said Aug. 15 that the partners plan to revise the program, reflecting the new environment. He conceded that the COVID-19 pandemic and Western sanctions against Russia have affected the CR929, a project of the Shanghai-based Craic joint venture of UAC and China’s Comac.

“The pandemic has changed the air transport market, changed the requirements to the [aircraft] range, passenger capacity, operational parameters, fuel costs and the significance of some or other factors,” Slyusar said. Sanctions imposed by Western countries against UAC and the Russian aerospace industry in response to Moscow’s invasion of Ukraine have had a deep effect on what suppliers can be used, he added. The CR929 program initially aimed to attract leading global aerospace suppliers, including Western engine manufacturers like Rolls-Royce and General Electric.

“It is clear that we can’t develop the project further in the initial configuration . . . in such a situation,” Slyusar said. “Together with the Chinese comrades, we should assess all this and understand how to move on.”

The CR929 remains the only international program operating commercially for Russia after Western suppliers stopped participating in the UAC Sukhoi Superjet 100 and Irkut MC-21 projects earlier this spring. UAC now tries to replace foreign components on these models with Russian-made products, and the company argues this experience can potentially be applied to the CR929 as well.

But China seems to have a different view. The South China Morning Post, a Hong Kong-based newspaper, recently quoted a Chinese source who said that key components such as the landing gear should be sourced from Western suppliers, as China continues to be keen to fly—if not sell—the aircraft internationally. Given the economic sanctions in place and Russia’s political isolation since the invasion of Ukraine, Western participation in the project appears to be elusive in the near future.

Vasily Kashin, director of the Moscow-based Center for Comprehensive European and International Studies, argues that substituting imports with local products in commercial aviation should also be a priority for the Chinese side because of the threat of renewed U.S. sanctions. In January 2021, the U.S. government added Comac to the list of companies with alleged ties to the Chinese military, introducing additional export license requirements on U.S.-made parts for Comac aircraft programs such as the C919 narrowbody. The aircraft relies heavily on foreign suppliers. Since then, the company has been removed from the list.

“The Chinese [manufacturer] has no experience in the design of widebody aircraft, which the Russians have,” Kashin says. UAC still assembles Ilyushin Il-96 widebody passenger aircraft for government clients and is looking at ramping up the type’s production now that the country’s airlines have lost access to Western-made jets. Russia also develops the PD-35 turbofan engine, which could suit the CR929 requirements.

Kashin warns the China may ask for a greater role in the CR929 program, as it has a larger market for the new type and has more money to invest in the program. Indeed, distributing future revenues appears to be a contentious issue. Additional reporting from the South China Morning Post states China wants all revenues generated in sales to domestic customers, while Russia would get 70% of revenues in international deals—which could be extremely limited.

Another item of concern for the Russian side is the Chinese focus on getting the C919 ready for entry into service this year. In July, Comac said all flight testing was completed. The first aircraft is to be delivered to China Eastern Airlines before the end of August.

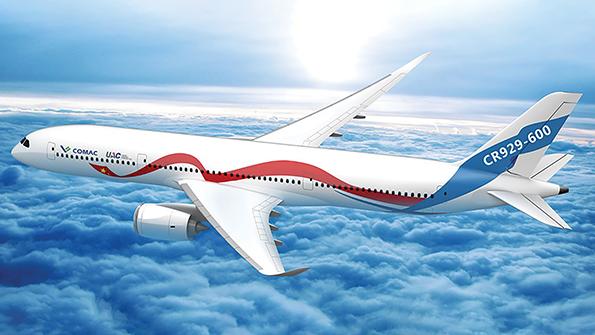

While work on components of the initial CR929 flight-test aircraft is reported to be underway, the exact design of the aircraft appears to be in question again. Slyusar indicated that the aircraft will look different from earlier plans, but it is unclear yet what changes entail. The baseline CR929-600 is intended to carry 280 passengers in a three-class configuration and should have a range of 12,000 km (6,480 nm).

—With Chen Chuanren in Singapore and Aviation Week Network Staff