British Airways' announcement that it will increase capacity to key US markets could be viewed as a vote of confidence in a market that has been losing passenger numbers in recent years. IATA BSP data between May 09-10 shows that just over 13 million passengers travelled between the UK and the US (two-way). However, during the same period the previous year, 14.2 million passengers flew and the year before that the number was 15.2 million passengers. So there has been a gradual decline in traffic flows but this market was also heavily impacted in the global slowdown, beginning in mid-2007.

CAA data allows us to measure traffic data over a longer period of time. Transatlantic traffic was at its peak pre 9/11 when in 2000, 19,563,363 passengers flew between the UK and the US with a load factor of 76%. In 2001 and post 9/11 this number dropped to 16,918,232. Numbers had gradually risen until 2007 when the financial markets crashed and traffic was at its lowest level since 2001 with CAA data showing 16,049,906 passengers flew in 2009.

WHY HAS THE MARKET DECLINED

The transatlantic market is more sensitive than most to the economic slowdown. With business class passengers the first to stop flying during a tough economic climate, carriers flying between the US and the UK are particularly impacted. BA premium passengers from London Heathrow are mainly from the financial sectors. Its restoration of flights on the key LHR-JFK sector is a signal economic recovery in the UK and the US.

The transatlantic market is one of the most important - and valuable markets in the world and the table below illustrates the leading seven carriers in terms of seat capacity from the UK to the US for this coming winter season.

|

Carrier |

Weekly Seats |

Route Pairs |

Capacity Share |

|

74,250 |

19 |

38% |

|

|

38,819 |

10 |

20% |

|

|

24,007 |

8 |

12% |

|

|

17,006 |

7 |

9% |

|

|

15,492 |

7 |

8% |

|

|

14,112 |

4 |

7% |

|

|

5,264 |

3 |

3% |

|

|

Others |

5,266 |

3% |

|

|

Total |

194,216 |

100% |

Source Flightbase 14-20 November 2010

Currently there are 11 carriers operating between the UK and the US, with other carriers operating extension flights. There are Air New Zealand between London Heathrow and Los Angeles, Kuwait Airways from Heathrow to JFK and Pakistan International Airlines and Biman Bangladesh operate from Manchester to JFK.

THE UK TO US MARKET IN 2007

Flightbase data below illustrates the UK-US market in winter 2007,with the leading carriers outlined in the table below.

|

Carrier |

Weekly Seats |

Route Pairs |

Capacity Share |

|

British Airways |

88,128 |

20 |

38% |

|

Virgin Atlantic |

45,637 |

13 |

19% |

|

American Airlines |

30,034 |

9 |

13% |

|

United Airlines |

17,150 |

4 |

7% |

|

Continental Airlines |

13,719 |

8 |

6% |

|

Delta Air Lines |

8,729 |

5 |

4% |

|

US Airways |

4,970 |

3 |

2% |

|

Others |

29,559 |

11% |

|

|

Total |

233,446 |

100% |

Source Flightbase 14-20 November 2007

In 2007 the top seven carriers were the same, however there were 18 carriers operating between the two countries. Northwest Airlines flights are now operated under the Delta name but a number of carriers have also disappeared since 2007.

This includes the premium business-class only carriers that disappeared as quickly as they arrived - EOS Airlines, which operated Stansted to JFK and Maxjet, which operated Stansted to JFK, Las Vegas and Los Angeles. UK-based Silverjet also vanished from the market quickly, meaning the demise of its service from London Luton to Newark.

Ultimately these carriers failed as the premium market which was in the middle of a severe downturn, which showed passengers' preference for network carriers and the benefits that they bring in terms of ticketing arrangements, frequent flyer programmes and hub airports.

Flyglobespan, which was operating a Belfast and Glasgow to Bangor, Maine, has also ceased operations and BMI has discontinued its services from Manchester to Las Vegas and Chicago.

London Gatwick has also been the big loser in the UK since the signing of UK - US Open Skies in April 2007. The airport has lost American Airlines' flights to Dallas/Fort Worth and Raleigh Durham as well as Continental Airlines flights to Newark and Houston. US Airways and Delta Air Lines still operate from London Gatwick but US Airways has discontinued flights to Philadelphia, which it now operates this from London Heathrow. In addition, Delta/Northwest has discontinued flights to Cincinnati, New York, Detroit and Minneapolis.

BUT IS THE MARKET RECOVERING?

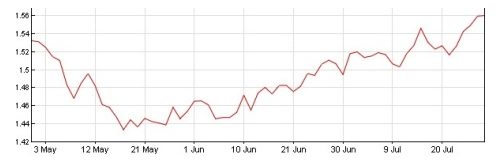

The US economy is recovering and the UK financial sector appears to be showing signs of recovery, aided by Sterling being at a three month high against the dollar, which is illustrated below

Source: Digital Look

BA's confidence in the recovery is no doubt a reflection in the improving yields on the US-UK markets. Volumes appear to be flat comparing May 2010 to May 2009, but the jump in yields between the two city pairs from London Heathrow is large - JFK is +27%, and the increase on BOS is 24%. Weak Sterling rates have boosted UK exports, and the demand by the financial services for corporate travel seems to be returning as mergers and acquisitions are on the up. BA may be looking to exploit these market conditions before having to shed routes and slots for its integration of its partnerships with Iberia and American Airlines.