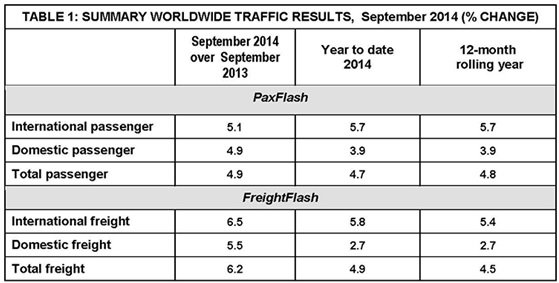

For the period from January to September 2014, passenger traffic grew by 4.7% on a year-to-date basis. Passenger numbers also grew by almost 5% year-over-year for the month September. Airports reported an increase of 5.1% in international passenger traffic; domestic passenger traffic increased by 4.9% as compared to September 2013.

African airports continue to experience a strong recovery in passenger traffic. North Africa's passenger traffic strengthened after a dismal period in 2012 and 2013 due to the unrest brought on by the Arab Spring. Following the overthrowing of President Morsi in Egypt, the tourist economies in the region were crippled as passenger traffic dropped significantly in 2013. Cairo (CAI) and Hurghada (HRG), two of Egypt's major airports, saw passenger traffic jump back by 23.2% and 457.2% respectively for the month of September. Despite the outbreak of the Ebola crisis, overall African passenger traffic increased by 9.6%.

The Middle East also achieved robust growth in passenger traffic at 9.3% for the month of September. Dubai (DXB), the world's busiest international airport, and Doha (DOH), another major international airport in the region, both achieved growth of 10%. Abu Dhabi (AUH) also achieved a significant increase of 23.9% in passenger numbers for the month of September.

The Asia-Pacific region experienced growth of 5.1% in overall passenger traffic. The domestic Chinese market was a large contributor to this growth. Many Chinese airports achieved double digit gains in passenger traffic.

European airports continue to recover in 2014 from the weakened Euro area that persisted throughout 2013. While Paris (CDG) saw a sharp decline in passenger traffic by 12.3%, this was attributable to Air France's pilot strike in the latter half of the month. On the upside, both Istanbul airports (IST and SAW) reported impressive gains of 11% and 18.5% respectively. On the whole, passenger traffic at European airports increased by 4.6%. North American and Latin America-Caribbean airports grew by 4.5% and 4.1% respectively in passenger traffic.

Global air freight traffic continued to maintain the upward trend in volumes and year-over-year growth rates for the month of September. The overall accumulated volumes for the last twelve months rose by 4.5% while volumes jumped up by over 6% on the month. Both the domestic as well as the international freight market posted robust gains for the month of September. International freight volumes jumped up by 6.5% whereas domestic volumes increased by 5.5%.

Asia-Pacific posted strong increases air freight volumes at 6.1% for the month of September. The world's largest air freight hub, Hong Kong (HKG), increased volumes by 5.8% for the month.

North America also experienced buoyant air freight traffic growth following a weakened air freight market in 2013. Memphis (MEM), North America's busiest freight airport and FedEx hub, and Louisville (SDF), the UPS hub, grew by 4.5% and 7.7% for the month of September.

With ongoing weakness in the Brazilian and Argentinean economies, freight volumes in Latin-America-Caribbean contracted for the month of September by 1.4%. Europe and Africa experienced more moderate growth in the realm of 3% year-over-year.

Dubai World Central (DWC), the Middle Eastern airport that has experienced exponential growth, is now a major contributor to overall increases in freight volumes for the region. Although it has only recently commenced operations, by the end of September alone, air freight volumes at DWC have surpassed the 500 thousand metric tonne threshold on a year-to-date basis, which represents an increase of over 255% as compared to the previous year.

"The global economy continues to experience a rocky recovery," said ACI World's Economics Director Rafael Echevarne. "Major economies such as the United States, the Euro area and Japan faced weak output growth in the first half of 2014. Emerging markets also felt the brunt of the slowdown with Brazil slipping into a recession. The geopolitical tensions in Eastern Europe and Russia continue to threaten business confidence across those regions as well. In spite of the strong positive relationship between airport traffic and the broader economy, aviation markets remain resilient and continue to grow."

Passenger traffic in the Euro area and North America will likely experience higher growth levels as compared to 2013 with global growth in passenger traffic ending the year in the realm of 5% for 2014."according to Echevarne. "Air freight also continues to show a glimmer of hope, irrespective of downside risks in the global economy. Volumes have remained above 2013 levels for all of 2014 up to the fourth quarter. This is cause for optimism given that the air freight markets were particularly sluggish over the last three years. Growth in global freight volumes will likely end the year in the realm of 4% for 2014 as compared to the previous year's volumes," he added.