An artist’s image of a OneWeb low-Earth-orbit, Ku-band satellite in space.

Satellite inflight entertainment and connectivity (IFEC) suppliers to business aviation in the last year have unveiled several new partnerships and service offerings, most of which remained nascent in September as the NBAA Business Aviation Convention & Exhibition (NBAA-BACE) approached.

At the European Business Aviation Convention & Exhibition (EBACE) conference in Geneva in May, air-to-ground (ATG) network operator Gogo revealed that it has partnered with upstart OneWeb, the developer of a new low-Earth-orbit (LEO) satellite constellation. Rival Satcom Direct also announced a pairing with OneWeb and demonstrated its new Plane Simple antenna system for Intelsat’s FlexExec satellite broadband service. Inmarsat said it was upgrading its Jet ConneX (JX) service used on 1,150 business aircraft to JX Evolution to vastly increase inflight download speeds.

Separately, OneWeb and Intelsat signed a distribution partnership in August to combine services from their respective LEO and geostationary (GEO) satellites. In July, French GEO satellite operator Eutelsat, an equity investor in OneWeb, announced an agreement to acquire the UK-based LEO satellite operator for $3.4 billion. In an even larger transaction, Viasat in November 2021 revealed its plan to acquire Inmarsat for $7.3 billion, which will combine the resources of major legacy satellite communications (satcom) providers to aviation.

Aircraft manufacturers and operators are already showing interest in LEO networks. At the Farnborough Airshow in July, De Havilland Aircraft of Canada said it plans to integrate an antenna for reception of Starlink—SpaceX’s rival LEO service—in its relaunch of the Dash 8-400 twin turboprop. Part 135 air carrier JSX said in April that it had selected Starlink for its fleet of 30-seat Embraer regional jets.

The recent maneuvers herald the arrival of thousands of new LEO spacecraft continuously orbiting hundreds of miles above the Earth. Major legacy satellite operators plan to interconnect LEO fleets with fixed GEO satellites orbiting at more than 22,000 mi. to create “multiorbit” communications networks operating at broadband Ku- (12-18 GHz) and Ka-band (26.5-40 GHz) frequencies.

IFEC suppliers are responding to the promised new bandwidth by developing smaller antenna systems to connect with different Satcom constructs, as well as onboard hardware/software platforms that integrate space-based connectivity systems with terrestrial systems using bottom-mounted antennas.

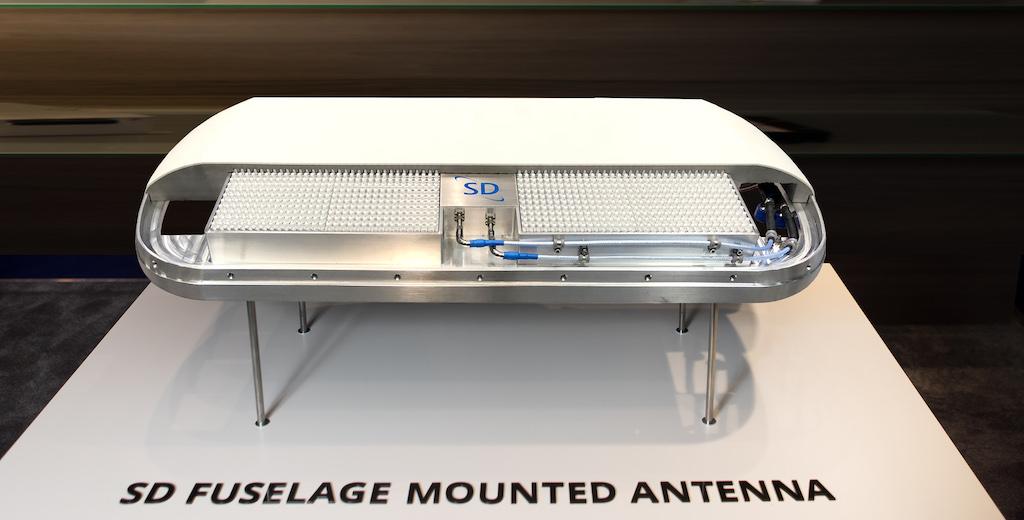

“Our entire strategy is based around that,” says Satcom Direct President Chris Moore, who notes that his company is developing mechanically steered, tail-mounted Plane Simple antennas for Intelsat (Ku-band) and Inmarsat (Ka-band) GEO service as well as a new fuselage-mounted, electronically steered antenna (ESA) for OneWeb’s Ku-band LEO satellites.

“We’re investing in GEO-based antennas for the tail and also LEO antennas for the fuselage,” Moore says. “We believe our routing capability, our modem capability, will be able to use the best of both worlds across all sorts of multi-orbit networks. We saw this coming in about 2018. There’s going to be more consolidation with the network operators [and] there’s more capacity than ever before. I think multiorbit is definitely the way forward.”

In July, before its acquisition by Viasat was revealed, Inmarsat unveiled a future mesh network the company has branded as “Orchestra,” which will integrate its GEO satellites operating in the L- and Ka bands with 150-175 new LEO satellites and terrestrial 5G cellular communications.

“We certainly believe that multidimensional networks are the future, seamlessly combining different orbits and terrestrial 5G networks to provide customers with the most effective and efficient service,” says Kai Tang, Inmarsat head of business aviation. “However, GEO networks will lie at the heart of our space-based infrastructure, as it is the most efficient orbit for delivering global coverage.”

Inmarsat has said that it will focus 5G terrestrial capacity on high-demand hot spots such as ports, airports and sea canals, whereas LEO satellites will layer additional capacity over oceanic flight corridors. “What is most important is that each component, in whichever orbit, is built to support the unique demands of mobility customers—and is not simply a repurposed network that is designed for . . . other consumer markets,” Tang says in response to a ShowNews inquiry.

Gogo Business Aviation plans to integrate service from new OneWeb Ku-band satellites with 5G terrestrial connectivity through its onboard Avance platform. As of September, launch provider Arianespace had placed 428 of OneWeb’s planned 648 LEO satellites into orbit before suspending its use of Russian Soyuz rockets because of the Russian invasion of Ukraine. Plans call for SpaceX and the commercial arm of Indian space agency ISRO to deliver the remaining spacecraft to LEO. As of July, Gogo said it had installed half of the 150-tower ground infrastructure for its new 5G ATG network, which it expects to launch this year.

OneWeb And Starlink

Sergio Aguirre, Gogo Business Aviation president and chief operating officer, thinks that aircraft operators choosing to install Satcom terminals for the first time will favor LEO-based broadband networks requiring smaller form factor equipment over legacy networks based on GEO satellites. Operators with existing installations will be reluctant to replace those terminals because of the capital investment they have made.

“I don’t see them taking them off their aircraft,” Aguirre says. “Going forward, on new installations, traditional GEO satellite companies are going to be disadvantaged on cost. I think we’re going to see a shift on new installations that is going to be geared toward the LEOs. It’s hard to say which ones are going to be successful, but OneWeb and Starlink are the only players that have satellites in orbit, have access to capital and have proven technology.”

The multiorbit strategy being pursued by legacy Satcom providers may work for large aircraft capable of hosting existing mechanically steered antennas to track GEO satellites, but not for smaller aircraft of lesser size, weight and power flexibility, Aguirre contends.

“Here’s the problem with that: You have to design your antenna for the least efficient network for it to operate [with] and that is the GEO network,” Aguirre says of planned multiorbit systems. “If you want to put a multiorbit-system antenna on your aircraft, you’re going to have to have at least the same size antenna that still limits you to the heavy-iron aircraft. Many of our customers today with big-iron aircraft have both a Gogo [ATG] system and an Inmarsat system, and they do that to augment Gogo coverage outside of the United States.”

Electronically Steered Antennas

Gogo is developing a new, flat-panel ESA antenna with Hughes Network Systems to track OneWeb’s closer LEO satellites. Hughes is applying its ESA technology, but Gogo will own the intellectual property of the antenna, which will be small enough to install on business aircraft ranging from light jets and large turboprops to ultra-long-range large cabin jets.

“Our entry point to the market is going to be light- and midsize aircraft,” Aguirre says. “We picked a form factor of an existing intermediate gain antenna that we know has already been installed successfully on King Airs all the way up in terms of the envelope of the antenna. We’re a little bit larger than that footprint, but in our discussions with the [aircraft] OEMs, we think we’ve met that technical requirement. We want to make sure that we can address any turboprops and light jets on up.”

Satcom Direct, its partner QEST Quantenelektronische Systeme and OneWeb are developing a fuselage-mounted, flat-panel ESA sized for smaller aircraft, such as the Phenom 300 or Citation CJ3, Moore says. It expects to begin over-the-air testing of the antenna by year-end or early 2023.

Viasat-3 Constellation

Viasat plans to deploy a new generation of three high-capacity Ka-band satellites into GEO beginning with Viasat-3A, covering the Americas, in early 2023; the other two spacecraft will launch at 6-month intervals. The company builds its own Satcom terminals in Duluth, Georgia, and satellite payloads in Tempe, Arizona. Its GAT5510 terminal consists of a mechanically steered, 12-in. parabolic dish that is installed on the tail of a business jet, an antenna power supply unit and a modem.

Through its center of excellence in Lausanne, Switzerland, Viasat and European partners have developed a flat-panel, phased-array antenna that is electronically steered. The company flight-tested the ESA antenna on a Cessna Citation in April 2021. “Viasat is targeting a unique phased array antenna that will hit the right price point and leverage the multiorbit, multibeam, high-throughput, flexible and open architecture system of the future,” the company said after the demonstration flight.

The advantage LEO satellites provide is their coverage of polar regions beyond the reach of GEO spacecraft, and Viasat aims to operate a small fleet of LEOs to which Inmarsat may contribute. Nevertheless, the company’s view is that multiorbit networks anchored on 1000 GBps. Viasat-3 satellites will provide the best solution for aviation, says James Person, Viasat head of sales and business development for business and VVIP aviation.

“Our view is a LEO network is not the best way to provide connectivity to business jets,” Person says. “The best way to do it is large-capacity GEO satellites that give you flexibility to manage where you put your capacity. The challenge with LEO networks is [that] by design they have to spread their capacity evenly over the globe—whether it’s Starlink with their 12,000 satellites or OneWeb with their smaller network.”

“Business aviation is very concentrated in North America and Europe,” Person adds. “Our satellites are extremely flexible in terms of where their power and capacity are. Early morning [on the] East Coast, when Teterboro, [New Jersey,] and West Palm Beach, [Florida,] wake up, all our power in the satellite is focused on the East Coast and it automatically shifts during the day to where it’s needed. You can’t do that with a LEO network.”

Viasat’s Person and Gogo’s Aguirre disagree on whether latency is a consequential advantage of LEO networks. Latency is the time delay over a communications link, measured as the roundtrip time in milliseconds, for data to travel up to a satellite, down to a server on the ground and back to the aircraft. For a LEO satellite that trip can take less than 100 millisec.; for a GEO satellite more than 600 millisec..

Aguirre contends that multiorbit networks that facilitate hopping from low-latency LEO to high-latency GEO satellites will have discernable lags that diminish the user experience. Person says that latency is only an issue for two main applications: high-frequency trading of securities and online video games such as Twitch and Fortnite.

“We’re the provider for all of the [U.S.] blue-and-white fleet, from Air Force One on down,” Person says. “Our customers do secure videoconferencing every day of the week on our GEO network; it’s just not an issue.” He allows, however, that “we actually lost a customer who had a G650 who wanted to do rapid equity trading.”