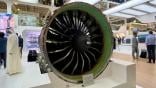

Credit: Airbus SAS 2017 Alexandre Doumenjou - master films

Pratt & Whitney’s ability to keep up with spare parts demand and tailor overhaul workscopes are seen as keys to managing PW1100G geared turbofan (GTF) groundings and potentially reduce the disruptions customers are seeing, a top executive of parent company RTX said. “The MRO network is really going...

Subscription Required

Pratt: Material Flow Driving GTF Grounding Durations is published in Aviation Daily, an Aviation Week Intelligence Network (AWIN) Market Briefing and is included with your AWIN membership.

Already a member of AWIN or subscribe to Aviation Daily through your company? Login with your existing email and password

Not a member? Learn how to access the market intelligence and data you need to stay abreast of what's happening in the air transport community.