Airbus confirmed Oct. 29 it may raise single-aisle production rates to 47 aircraft per month from 40 at some point in 2021, a move that would be “backed by the backlog," according to CEO Guillaume Faury.

The manufacturer’s current production and supply plan assumes it will raise output by the end of the second quarter of 2021. In an earlier version of the plan, it was anticipated that move would come by the beginning of the second quarter, but Airbus put off the increase as air-travel recovery has been slower than expected. “We are in a lower-for-longer scenario,” Faury said. Nonetheless, he emphasized “it is important that the supply chain is prepared, and we expect suppliers to be committed and ready.”

Extended market weakness could lead Airbus to delay the decision to increase output again further into the second half of 2021. And one important supplier, MTU Aero Engines, already has voiced caution. “There is a certain skepticism [among suppliers] that this will really happen,” CEO Reiner Winkler said. “We are assuming Rate 40 but can be flexible and react quickly. I would wait a little more before we make financial commitments.”

Faury stressed that “Rate 40 is solid” in spite of several analysts having suggested recently that production should be reduced to around 30 aircraft per month, given that many airlines are in financial distress.

In the first nine months of 2020, Airbus delivered 341 aircraft, 230 less than a year ago: 18 A220s, 282 A320-family aircraft, nine A330s and 32 A350s. Compared to 2019, Airbus delivered 155 fewer narrowbodies and 75 fewer widebodies.

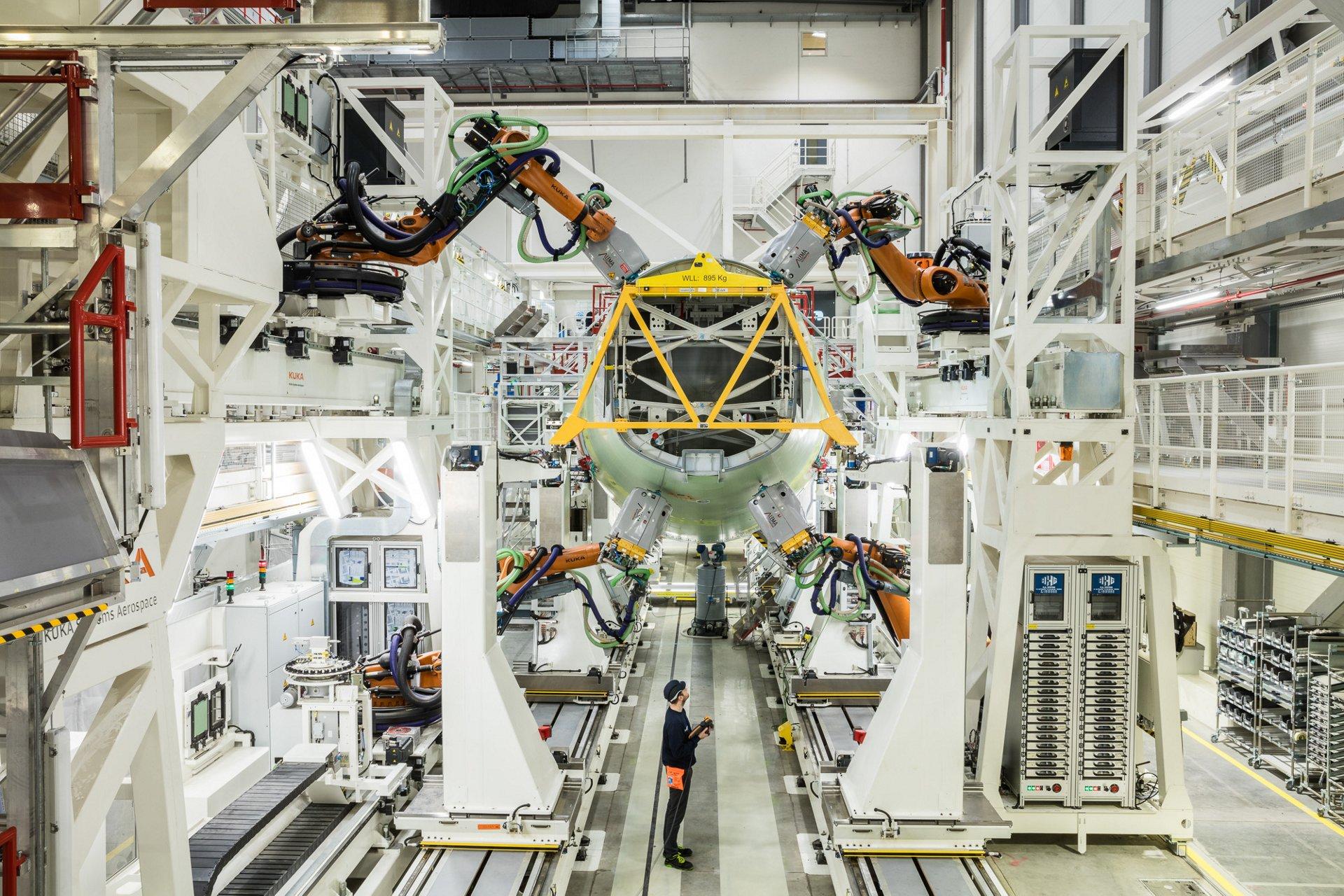

Single-aisle production was cut earlier in 2020 to 40 aircraft per month from more than 60. A350 rates were reduced to six per month from 10 and later to five. A330 production was halved.

In the 2020 third quarter, a total of 135 aircraft were delivered, and Faury believes “production and deliveries now are converging.” Airbus still has 135 aircraft that have been built but not delivered. But according to CFO Dominik Asam, a little more than 10 of the 135 are actual “white tails,” with no customers. The vast majority are aircraft for which deliveries have been deferred by 1-2 years.

Faury made it clear the A330 remains “an important piece of the puzzle.” Airbus has reduced the production rate of its smallest and oldest active widebody program to two aircraft per month, which Faury believes is still “sustainable.” He believes the A330 has the potential “to be a very good aircraft to move out of the pandemic. Airlines will be looking for very cost-efficient solutions.”

The very low level of production has raised questions whether the A330 has a future or may be dumped as Airbus aims at stemming overall losses. However, such a move would give Boeing a monopoly for the 787 size and range and is—if only for that reason—not in the works. Airbus had been pricing the A330neo aggressively in pre-COVID-19 campaigns but its backlog—marked by large and highly questionable orders from Air Asia X and Iran Air—remains weak. Faury pointed out, however, that airlines will need to replace the in-service A330 fleet in due course.

Unlike for narrowbodies, Airbus does not anticipate increased output for the A350 “in the foreseeable future.”

While Airbus recorded a negative free cash flow before mergers and acquisitions and customer financing of €11.8 billion ($13.8 billion) for the first nine months of the year, more than twice the amount for 2019. Cash flow turned to a positive €600 million in the third quarter as the number of deliveries grew and benefits from cost cuts became visible.

In the commercial business, Airbus suffered a 33% decline in revenues to €7.7 billion in the third quarter, compared to a 43% drop in the first nine months to indicate its financial performance is improving slowly. The unit posted a €591 million operating loss, compared to a €1.12 billion profit a year earlier. Restructuring charges of €1.2 billion weighed heavily on group results; €981 million is recognized in the commercial aircraft division as the company moves ahead with job cuts and other cost reductions.