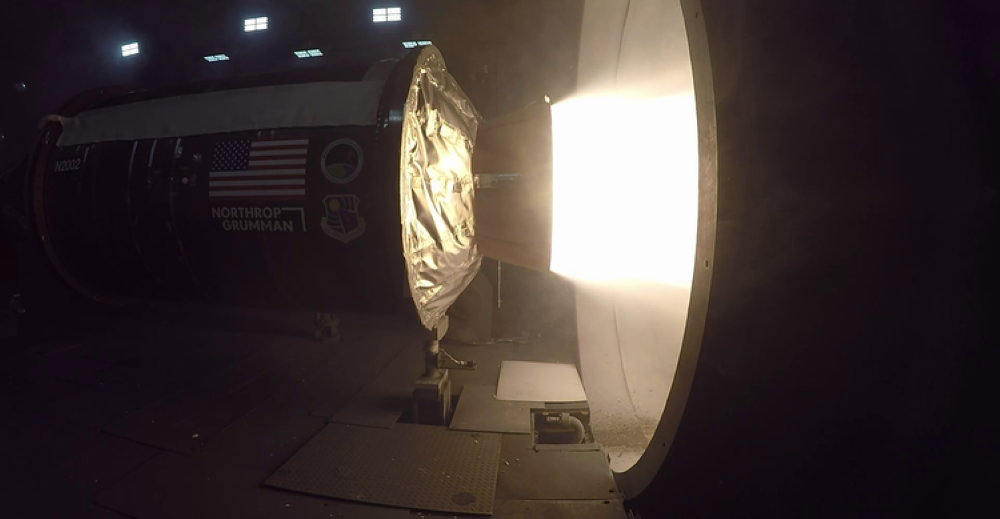

Northrop Grumman recently test fired a digitally designed and manufactured solid rocket motor at the Air Force’s Arnold Engineering Development Complex.

HUNTSVILLE, Alabama—Northrop Grumman is increasing its solid rocket motor (SRM) production capacity to get ahead of a potential surge demand, while looking at different ways to produce tactical motors to go farther, faster and potentially cheaper.

The company is tripling its capacity at Maryland and West Virginia production facilities that make solid rocket motors used in tactical-level systems—air-to-air, air-to-ground and surface-to-surface missiles, as the war in Ukraine has shown both the need to replenish U.S. stocks and to create a surge capacity, says Jim Kalberer, Northrop Grumman’s vice president for propulsion systems. At the same time, it is doubling capacity at its Utah facility that makes larger solid rocket motors, those used for space launches and critically the new LGM-35A Sentinel intercontinental ballistic missile.

Northrop Grumman started much of the capacity increase before the demand spiked, going back about five years, Kalberer says. This includes modernized, automated propellant mixing facilities in Utah and construction of 13 new buildings. Overall, the company has 7.5 million sq. ft. of space devoted to SRM production.

The Promontory, Utah, facility has over the past 10 years delivered 900 motors, including 19 new developments—12 of which have been static fired. Three hundred have flown missions, Kalberer told Aviation Week on Aug. 8.

Northrop Grumman is building the first two stages of the Sentinel missile at Utah, with motors for static test and flight test in production.

The company’s West Virginia facility, part of Naval Sea Systems Command’s Allegany Ballistics Laboratory, has churned out 110,000 small and medium SRMs over the past five years with capacity increasing. This includes a new 113,000-sq.-ft. missile integration facility, which will begin to churn out 300 strike missiles per year to expand to 600 per year. The company in March received a $178 million contract from NAVSEA to support expansion. The facilities can meet current requirements, with space to surge more, the company says.

“There’s a recognition that surge capacity needs to be built into the factories in the event we would need to build more than we currently plan to build,” Kalberer said on the sidelines of the Space and Missile Defense Symposium here.

The company’s tactical motors include those that power the TOW anti-tank missile, AIM-9 Sidewinders, AIM-120 Advanced Medium-Range Air-to-Air Missiles, Hellfire, Harpoon, Guided Multiple Launch Rocket Systems, Standard Missile-3 and the Rolling Airframe Missile Block 2.

Kalberer argues Northrop’s investments have gotten the company ahead of the current seemingly insatiable demand, with Pentagon leaders calling for increased capacity to meet the surge need. If the new facilities were not completed and customers came to the company to tell it to double production, the answer would have been it would take two to three years to do so, Kalberer says.

The biggest challenge facing the SRM industrial base has been the supply chain. This does not mean there is a shortage, but instead there are “supply chain concerns,” Kalberer says. Multiple companies are relying on the same supply base, which is stretched thin based on the demand.

“Supply chain is a watch point. As we surge, we have to ensure they are ready to surge,” he says.

To help this, the Pentagon and other customers need to ensure that the demand signal is visible so companies can prepare. The Defense Department has tried to address this through steps such as getting multiyear authorities for key weapons.

Another challenge is the amount of time it takes for new facilities to come online. The advanced propellant mixing facilities in Utah, for example, took multiple years. So the company was in the right place when the increased demand for space launch came.

Pentagon leaders, recently including the U.S. Army’s program office for space and missiles, are calling on industry to find new ways to make missiles fly farther, faster and cheaper. This can be met by new propellant mixes, and Kalberer says Northrop Grumman is “pushing the edge of physics” with new tactical programs to meet the need to go farther, though he would not elaborate on specific programs.

There is also an emerging need for strike missiles to be cheaper. The U.S. Air Force, for example, is starting a program with an eye on arming Ukraine called the Extended Range Attack Munition with the goal of a cheap, air-launched missile. Similarly, the U.S. Navy is calling for new weapons that are cheaper to take better advantage of limited magazine space on ships. Kalberer says Northrop Grumman’s approach to meeting this need is partly through its SRM facilities—using a faster design cycle and modular tooling so facilities can be multiuse, cutting back on the overhead needed for multiple programs.