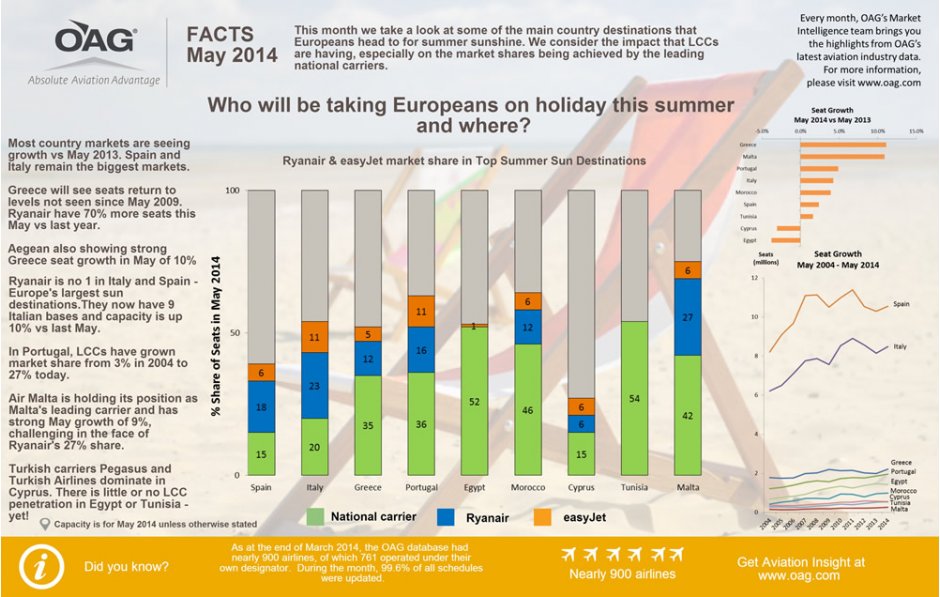

This summer, Greece will see its airline capacity return to levels not recorded since the summer of 2009, driven by Ryanair’s rapid entry strategy, according to OAG, a leading aviation intelligence provider. In May 2014, there will be a total of 4.4 million seats available to and from Greece versus 3.8 million in 2013 and 4.4 million in 2009.

“Ryanair entered the Greek market in 2010, and since then has grown its market share to 12 per cent. Today, Ryanair is offering 70 per cent more seats from Greece than in May 2013, consistent with the airline’s tendency to expand quickly over a period of a few years and then subsequently consolidate its position. While May is not the peak of the summer season in Europe, airlines’ summer schedules have begun and so we get an indication of how the season will play out,” explained John Grant, executive vice president, OAG.

Malta has also seen its seat capacity grow in May 2014 in excess of ten per cent versus May 2013, representing the country’s highest ever level of airline capacity. Malta will see strong seat growth from flag carrier Air Malta which is offering nine per cent more seats than last May, whilst both Lufthansa and Emirates have significantly increased capacity.

Between 2009 and 2013, Ryanair increased available seat capacity by an average of 30 per cent each year in Malta. According to OAG, Ryanair is now pulling back slightly with a three per cent drop in capacity (since May 2013), but this is consistent with the airline’s recent tendency to expand quickly over a few years and then subsequently consolidate its position.

“Ryanair appears to be developing a pattern of servicing a main city airport as well as secondary airports for a single catchment area. We’ve all seen how Ryanair is becoming more customer friendly, but the changes run deeper than that. The airline is amending its original business model to adapt to the evolving market place and react to the finer line being drawn between LCCs and legacy carriers,” said Grant.

“We could see a new pattern emerging of Ryanair moving to more primary airports within Europe. In Scotland, Ryanair already operates from Edinburgh and Prestwick. Could we see Ryanair move into Frankfurt Airport next, alongside its operation at Frankfurt Hahn? Other European holiday markets such as Cyprus, Tunisia and Egypt are still relatively untouched by LCCs and may offer significant opportunities. Whether Ryanair pursues these opportunities remains to be seen,” he added.

The battleground for LCCs and legacy carriers is most prevalent in Italy, Ryanair’s largest summer European market. Ryanair is adding significant extra capacity with nearly 39,000 extra weekly seats from Italy in May 2014 versus May 2013. Ryanair is the largest scheduled carrier from Italy with 23 per cent of seats. The carrier opened four new bases in Italy in December 2013, bringing its total number of Italian bases to nine, one being Rome Fiumicino, supporting its primary airports strategy. Alitalia’s market share has fallen from 32 per cent in 2004 to 20 per cent in 2014 but appears to be mounting a defence with a seven per cent increase in seats in May 2014.

“While debt and job cuts have been cited as the main reasons for the stalling of discussions between Etihad and Alitalia, which would give the Gulf carrier a stake in the Italian market, no doubt the relative strength of Ryanair has been a factor in how Etihad approaches its due diligence,” said Grant.

Spain, the largest summer holiday market for Europeans, is growing again after two years of contraction in outbound capacity, with overall seats up 2.4 per cent from May 2013, according to OAG. Spanish growth is mostly being driven by Vueling which is adding nearly 170,000 extra seats this May. Ryanair and Iberia, the carriers with the largest seat capacity from Spain, are both reducing May capacity, with Ryanair reducing seats by four per cent and Iberia by two per cent.

OAG’s analysis of which airlines will be taking Europeans on holiday this summer is outlined in its OAG FACTS (Frequency and Capacity Trend Statistics) report for May 2014. You can see an infographic of the data below and can download the full report here.