ROUTES AFRICA: Boeing Reports Strong Demand from Africa Region

US aircraft manufacturer Boeing says Africans are increasingly turning to air travel to overcome road and rail infrastructure insufficiencies and will lead to a doubling of capacity over the next 20 year period. The findings are highlighted in Boeing’s recently unveiled Current Market Outlook 2011, in which the manufacturer tries its best to predict regional and global demand trends for the next two decades.

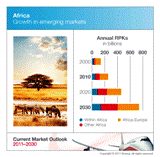

Overall traffic in Africa is expected to grow at a rate of 5.1 per cent, above the expected 4.4 per cent Gross Domestic Product (GDP) improvement, while freight will increase by 5.2 per cent. The manufacturer predicts a market of 800 new aircraft in Africa between now and 2030. This $100 billion business will be dominated by single-aisle airliners (510 aircraft) but there will also be strong demand for widebodied jets (230) to introduce new long-haul links a small number of regional aircraft (50) and around ten large aircraft for trunk routes.

Boeing has based much of its data on the forecasts of The World Bank, which predicts that the economies of sub-Saharan Africa will grow 5.3 per cent this year and 5.5 per cent in 2012. North African and the Middle East economies will grow 4.3 per cent this year and 4.4 per cent in 2012. Commodity markets account for much of this growth, according to the report, as manufacturing countries, particularly China, seek to hedge against volatility by negotiating long-term contracts with African producers of raw materials. Direct foreign investment, growing urbanisation, and rising incomes will also spur higher domestic demand for consumer goods and transportation though. The International Monetary Fund predicts that over the next five years, seven of the world's ten fastest growing economies will be in Africa.

With more Africans taking advantage of the developing air transport industry there has been a favourable climate for new aircraft orders and leasing opportunities over the past few years. The average age of the African fleet has declined as established airlines modernise for fuel efficiency and higher capacity, while more developed nations such as Nigeria and South Africa have undertaken ambitious airport infrastructure projects to alleviate congestion and address safety concerns.

Also, Boeing notes that many state-run airlines in Africa have given way to privately-owned entities that are better able to compete with the foreign operators currently predominant on intercontinental routes. Competition has markedly increased in recent years as Middle Eastern airlines have introduced larger capacity aircraft, higher frequencies, and lower fares to the African market, an area that until recently has been traditionally dominated by European carriers.

African airlines have responded by forming code-share agreements with foreign carriers, particularly with Asian airlines and Boeing suggests that the entry of African carriers as full or associate members into the three global airline alliances, Star Alliance, SkyTeam, and oneworld, “signals even more significant progress in African aviation”. The additional market reach that these alliances afford is expected to foster competition on intra-Africa routes and create opportunities for emerging unaffiliated carriers too.

To keep up to date with the latest news from this year’s Routes Africa follow the #Routes Africa hashtag on Twitter.