On the list of potential transatlantic routes, the Connecticut city of Hartford might not be too high for most airlines but September saw an Aer Lingus inaugural flight there, marking the carrier’s 10th destination in North America.

The inaugural flight was also a milestone in the latest transition of Aer Lingus. It will be a decade next March since Aer Lingus left oneworld and embarked on an ill-advised attempt to become a budget airline. The low-cost experiment was short-lived; anyone attempting to take on Ryanair on its home soil was certain to get badly bruised, while an accompanying venture to become Gatwick’s next big budget carrier ended in tears after only 18 months.

A restructuring, beginning in 2009 under “The Terminator” Christoph Mueller, saw Aer Lingus find itself a new niche as a hybrid short-haul airline with a small transatlantic network. It returned to profit but more change followed in August 2015, when International Airlines Group, headed by former Aer Lingus pilot Willie Walsh, bought the airline for ¤1.3 billion and began looking west.

Walsh recognised the potential for connections through Dublin and Shannon. Both have the considerable bonus of US customs and immigration pre-clearance, saving passengers more than an hour of queuing on arrival at America. Walsh says that despite Ireland’s small population of 4.76 million, “maybe 50 million” Americans have Irish connections and that transatlantic market is a key element of growth plans. His IAG corporate video is emphatic about Aer Lingus’s future.

“When we were going through the acquisition process, we said one of the great benefits for the group was Aer Lingus’s transatlantic market position, not only in terms of geography but also the huge market and a very strong brand in North America; plus it has a lot of links from the UK regions into Dublin. It is something IAG regards very positively,” he says.

The transatlantic pedigree is a long one. Aer Lingus has a 58-year history of serving New York and Boston from Dublin and Shannon and now has an extensive feeder network, not just from the 19 UK airports it serves but also across Europe. Services across the Atlantic from major UK regional airports have seen double-digit growth, with Manchester and Birmingham being the two most popular starting points.

“The geography is a big thing. We are en route from pretty much everyone travelling from the UK or Europe to North America. The pre-clearance is a bonus,” says an Aer Lingus spokesperson.

It is not just the UK that provides pick-up points for the North American routes. The Hartford service was begun because of the city’s role as a global insurance centre, with hopes that connections to Europe’s key financial hubs including Frankfurt and Paris will make it work.

Aer Lingus has been cautious in its approach with Hartford, using damp lease partner ASL’s Boeing 757s, which have 165 economy and 12 business-class seats. ASL operates four aircraft for Aer Lingus on the thinner Shannon routes and Dublin-Toronto, while the mainline fleet uses wide body Airbus A330-200s and 300s.

Hartford’s introduction follows the launch of mainline services from Dublin to Newark in September and the restoration of a Los Angeles route in May after an eight-year absence. This marks the airline’s biggest transatlantic expansion in 58 years and moving the carrier’s transatlantic seat capacity above two million for the first time.

IAG CEO Willie Walsh has said that Aer Lingus could “really push the boundaries” in terms of transatlantic growth but that it would not be reckless. The push is determinedly westwards, with no return, for example, to Dubai, once an Aer Lingus route; especially now the Middle East carriers have the eastwards market covered at Dublin. Aer Lingus realises that few want to back-haul from Europe or the UK and its brief point-to-point experiment with Dubai found that once everyone in Ireland who wanted to go there had been, there were no more passengers.

As Aer Lingus grows its transfer business, so Shannon, and in particular, Dublin airport, reap the benefits. Dublin has moved from 11th position in the ACI league of European transatlantic hubs in 2010 to fifth today. The airport claims to be the fastest-growing major European airport in 2016, 12% ahead of 2015, when it handled 25 million passengers.

Of these 25 million, only one million were transferring, but, says Gary McLean, Dublin airport’s head of operations: “The potential is enormous for us as long as we can ensure it is cost competitive and a positive experience.” Location, location, location is the key for him. “It is not adding a lot of additional journey time, particularly from the regions.”

The airport had already surpassed its 2015 total of one million transfer passengers by October this year. “The overall numbers might not sound impressive but growth is significant,” McLean says.

To this end, two new piers will be ready at Terminal 2 next summer (in time for Aer Lingus’s fleet additions), fulfilling US Customs and Border Protection’s requirements that connecting flights must be on secured stands. McLean added that there is an option for similar investment in a satellite building if needed. Future development depends on flight departure times – currently there is a mid-morning peak, when nine transatlantic services depart. If Aer Lingus adds more frequencies, rather than new routes, this will help smooth the peaks, lessening the need for more construction.

Dublin may, however, have to start building again as Aer Lingus brings new aircraft into the fleet. Aer Lingus’s new confidence really stems from IAG’s ownership, which effectively underwrites what it does and places aircraft orders across its brands (which embrace British Airways, Iberia and Vueling) as it feels appropriate.

In November 2015, almost as soon as Aer Lingus came under its umbrella, two IAG options for A330-300s (which in theory could have been destined for Iberia, an A330 operator) were exercised and delivered this year, while in July this year, an identical option was made firm, for delivery to Aer Lingus in 2017.

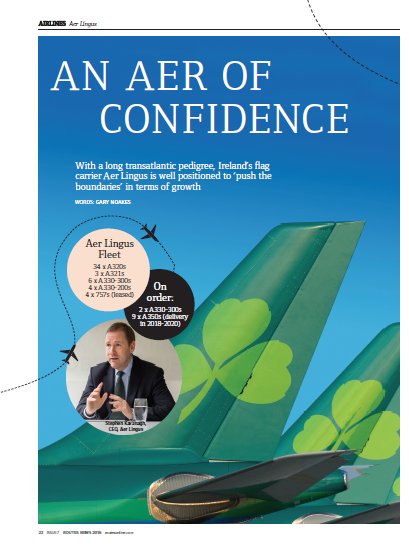

Next year, the additional aircraft will mean 12 A330s in the fleet and a threetimes- weekly Dublin-Miami flight starting on September 1, 2017 has already been announced. The carrier also has nine Airbus A350-900s on order for delivery from 2018-2020 at a rate of three a year.

What might excite recipient airports more is talk of an in-house replacement for the 757 with the Airbus A321LR. This summer, CEO Stephen Kavanagh said he was working on a business case for IAG for four to eight of the new variant. This is either for new markets or to increase frequency.

He should find a sympathetic ear, as Walsh has repeatedly said that the cost and time involved in expanding Heathrow means growth could be centred towards Madrid and Dublin instead. Walsh is also keen on a joint venture with American Airlines, similar to the one that American has with BA, Iberia and Finnair. This would mean joint marketing and revenue sharing but perhaps most importantly, code sharing with American, which would really open up the US for the Irish carrier.

The few years following IAG’s takeover of Aer Lingus may well come to be seen as a step change in its history. As the North American routes become established, there becomes more of a need for Aer Lingus to return to the oneworld fold, something that Kavanagh recently confirmed as an ambition and which, given the airline’s new parentage, is surely something on the near horizon.

|

This article is modified from an original feature that appeared in... ROUTES NEWS - ISSUE 7, 2016 PLEASE CLICK HERE to view the magazine. |

|