Nasair, a Saudi Arabian LCC, this week announced its expansion strategy in India, with flights to Mumbai, Kochi, Kozhikode [Calicut] and New Delhi. Routes News reports.

India is firmly on Nasair's radar, with the LCC announcing that it plans to expand into the country in its new summer 2010 timetable. The Saudi LCC launched its first service to India with flights to Mumbai in April. In the past it has served Indian passengers from Mumbai and from Calicut during the pilgrimage season.

Nasair has chosen to serve Kochi (three times weekly) from June 1, Kozhikode (four times weekly) from July 1 and Delhi (three times weekly) from August 1 - all operated with its A320 fleet from its Riyadh base.

The Saudi-India Market

The Nasair announcement is significant as the Saudi Arabia-India market is large, but is underserved by just three existing carriers: Saudi Arabian Airlines, Air India and Jet Airways.

The following table offers a summary of the current weekly scheduled seat capacity between Saudi Arabia and India, by carrier.

|

Airline Capacity Between Saudi Arabia and India |

||

|

Carrier |

Weekly Flights |

Weekly Seats |

|

Saudi Arabia Airlines |

68 |

19,860 |

|

Air India |

58 |

17,063 |

|

Jet Airways |

21 |

3,003 |

|

Total |

147 |

39,926 |

Air India and Saudi Arabia Airlines already operate Nasair's new routes Kochi, Calicut and Delhi. These are run with a low frequency, but with wide-bodied aircraft. Nasair should be able to match this frequency fairly quickly but will have a challenge to match the costs per seat.

On the Riyadh-Delhi route, Saudi Arabian Airlines already flies six times weekly using a B777 aircraft, while Air India has a smaller presence with a twice-weekly service. On the other sectors, Air India has the larger frequency and market share (detailed below).

Riyadh to Delhi (Weekly Frequency)

|

|

Aircraft Type |

Flight Frequency (Weekly) |

Seats (Weekly) |

|

Saudi Arabian Airlines |

B777 |

6 |

1,729 |

|

Air India |

B747 |

2 |

846 |

|

Total |

8 |

2,575 |

Riyadh to Kozhikode (Weekly Frequency)

|

Aircraft Type |

Flight frequency (Weekly) |

Seats (weekly) |

|

|

Air India |

B747/A320 |

6 |

1,426 |

|

Saudi Arabia Airlines |

A330 |

3 |

642 |

|

Total |

9 |

2,068 |

Riyadh to Kochi (Weekly Frequency)

| Carrier | Aircraft | Flights | Seats |

| Air India |

747/A320 | 5 | 1003 |

| Saudi Arabia Airlines | 777 | 2 | 488 |

| Total | 7 | 1491 |

Nasair has chosen to avoid Mumbai and Trivandrum, which are operated by Jet Airways. Interestingly, Trivandrum doesn't have a carrier operating the route from the Saudi end. South India is the larger market from Saudi Arabia because of its large population and economic links between the region and Saudi Arabia.

Battle for International Service: Nasair versus Sama

Nasair was developed from parent group National Air Services - originally a business VIP and charter airline business.

The race to establish a credible LCC in Saudi Arabia heated up in 2006 when both Nasair and Sama Airlines battled to start services. Sama Airlines was developed by LCC start-up consultancy Mango Aviation Partners and began its first commercial flight in 2007. Both airlines are today based at Riyadh and operate international services, although they have battled to obtain the traffic rights for international services.

Sama Airlines uses a fleet of B737-300 aircraft and its routes extend to neighbouring countries. From Riyadh, the carrier's international network includes service to Amman (AMM), Assiut (ATZ), Beirut (BEY), Damascus (DAM), Dammam (DMM), Alexandria (HBE) and Jeddah (JED). Sama also offers two services to Africa (Assiut and El Nouzha in Egypt). Plus, it has just launched three weekly flights from Jeddah to Khartoum [which began on May 3]. Although Nasair will fly the route first, announcing last month that it will connect the city pairs on May 1, with four weekly flights, increasing to a daily service from July 1.

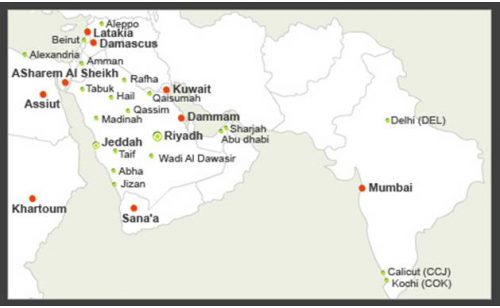

Nasair operates A320s and E190s to a wider international network than Sama Airlines, illustrated below:

Source: www.nasair.com

Nasair currently has 14 aircraft in its fleet, but has an additional four Embraer E190s (scheduled for delivery between 2010 and 2011) and three A320s (for delivery in 2012). Sama Airlines has a smaller fleet, comprising six 737-300s.

Nasair now has regulatory approval to become a joint-stock company with capital of $267 million in preparation for the launch of an initial public offering (pending approval). Nas Holding, which runs Nasair, is seeking strategic investments from Indian carriers, according to reports in the press.